Organic, but Unstable: QC Data Is the Gap in America’s $9.5B Produce Boom

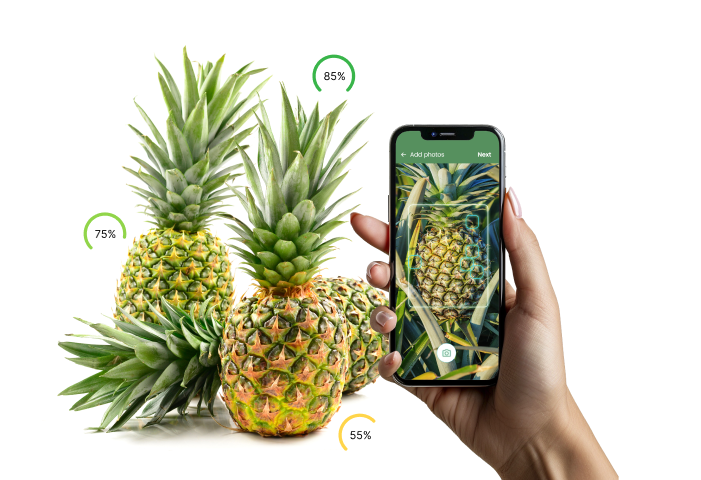

- Quality Control App

The U.S. organic produce market has entered a new era. In 2024, sales of organic fruits and vegetables reached $9.5 billion, a 5.7% year-over-year increase that more than doubled the pace of conventional produce growth.

What was once a niche is now a mainstream category. Organic produce accounts for 12% of all retail produce sales and 7% of overall volume. This is a milestone that reflects a generational shift in consumer priorities. Younger shoppers, in particular, are driving this growth, choosing organic not only for health reasons but as a symbol of sustainability and transparency.

Yet behind the optimism lies a quiet instability.

As organic volumes rise, cracks are forming in the system. Supply quality is variable. Climate is disrupting production. Inconsistent quality inspections keep processes locked in the past.

The very growth that has propelled organics forward is now exposing its weakest link: a lack of standardization in quality control.

Organic Is Booming, But Fragile

According to the State of Organic Produce 2024 report, categories like berries (+11.8%), apples (+6.8%), and bananas (+16.1%) led the surge.

These numbers highlight remarkable consumer loyalty. Consumers are choosing to pay a premium for organic, even as inflation pressures household budgets.

Retailers are also playing a key role. Many have expanded their organic assortments, adding more options in high-volume produce like avocados, packaged salads, and grapes. But as assortments grow, so do the complexities of sourcing.

Different growing regions, harvest conditions, and handling standards create enormous variability. A berry grown in the Pacific Northwest may not match the color profile or firmness of one from California. Tet both carry the same “organic” label.

Without shared quality benchmarks or digital oversight, these inconsistencies can quietly chip away at consumer trust.

The Quality Paradox: Premium Prices, Uneven Standards

Organic produce sits at the top of the price ladder. Several categories command high premiums: berries at around 66%, avocados at 55%, and bananas at 33% above conventional counterparts.

Of course, what comes with premium pricing is very low tolerance for inconsistency.

A single bruised apple or overripe avocado can make consumers question not just the brand, but the credibility of “organic” itself. And yet, most inspections in this category remain manual. Quality processes rely on subjective assessments that vary between growers, packers, and retail QC teams.

One buyer’s “Grade A” shipment might not pass another’s inspection, leading to unnecessary rejections, strained supplier relationships, and wasted product.

Climate is The Invisible Variable Undermining Organic Stability

Another emerging challenge for organic produce is climate volatility. Erratic weather patterns, prolonged droughts, and extreme temperature swings are disrupting both supply and pricing across major growing regions.

Organic producers already operate under stricter input limits and reduced chemical leeway, so these disruptions hit them even harder. Heat stress can shorten the life span of berries; excess rainfall can affect color, size, and sugar content in grapes. Even small variations can alter how produce looks, feels, and performs on the shelf.

Traditional QC methods aren’t built to detect these subtle shifts early. They record the outcome (a rejected batch) rather than the cause (a weather-related stress pattern developing weeks earlier).

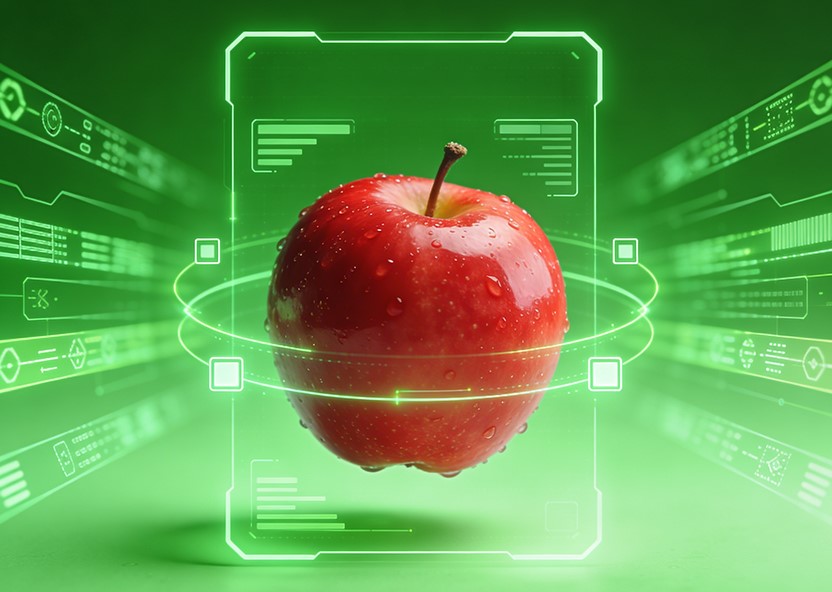

Data as the New Certification

Organic certification is vital, but limited. It validates how food is grown. But it doesn’t tell you how well it performs after harvest. A certified organic mango may meet every agricultural standard, yet still arrive inconsistent in color or texture if handled improperly along the way.

Retailers and wholesalers are starting to demand a new type of proof, one that complements certification with performance data.

AI-powered inspection can bridge this gap by providing a digital layer of quality verification. Each inspection becomes a data point, automatically logged, visualized, and traceable. Over time, these records build a living database of product consistency, lot by lot, supplier by supplier.

What Comes Next: Building a Consistent Organic Future

“Certified organic” says how you grow.

“Verified by data” says how well you deliver.

Organic growth is an operational success story. But scaling quality assurance hasn’t kept pace. The next test for the organic sector is delivering consistency at scale.

The path forward isn’t about replacing the principles of organic farming, but reinforcing them with precision and accountability. When every shipment is verifiable by data, “organic” can become not just a growing method but a measurable standard that justifies the premium.

Retailers who integrate digital QC into sourcing decisions will be able to see real-time quality trends across suppliers and seasons. Growers who adopt standardized inspection data will strengthen their relationships with buyers by demonstrating reliability, not just compliance.

Ultimately, data will become the connective tissue that transforms the organic movement from an ideal into an auditable, high-performance ecosystem.