In fresh produce, margins are tight, timing is critical, and quality can’t be compromised. When trade policy changes overnight, these pressures multiply. Only agile supply chains can keep up.

The tariff story of 2025 proves the point. In March, the industry braced for sweeping 25% tariffs on imports from Mexico and Canada, which together supply the majority of U.S. fruit and vegetables. Importers canceled contracts, retailers scrambled for alternatives, and price spikes seemed inevitable.

Five months later, the landscape has shifted again. The August 1 Executive Order left USMCA-compliant produce from Mexico and Canada exempt from new tariffs, while sharply raising duties on other trading partners. For some produce categories, the immediate threat has eased; for others, it has intensified.

Timeline: Tariff Announcements in 2025

- March 19, 2025: Proposed 25% tariffs on Mexico and Canada cause industry concern.

- July 7, 2025: Tariff expiration dates extended; reciprocal tariff updates announced.

- August 1, 2025: New Executive Order exempts USMCA-compliant produce from Mexico and Canada; higher rates applied to other countries.

Phase 1: The March Shock

In March 2025, the proposed blanket tariffs on Mexico and Canada triggered deep concern:

- Nearly 60% of the fresh fruit and about 35% of the fresh vegetables consumed in the U.S. are imported, with Mexico supplying over half of all fruit imports and more than two-thirds of vegetable imports (by value) in 2023.

- Retailers feared losing reliable supply; distributors worried about being stuck with unsellable, perishable inventory.

- Slim margins on commodities like tomatoes and bananas meant even small cost increases could erase profits.

Some growers even considered relocating production from California’s Salinas Valley to Arizona to avoid uncertainty.

Phase 2: The August Pivot

By the time the August 1, 2025 Executive Order was signed, the tariff picture had changed dramatically from the blanket approach feared in March. Instead of a sweeping 25% duty on all imports from Mexico and Canada, the policy carved out significant protections for North American produce, while turning its attention elsewhere.

- USMCA-compliant produce from Mexico and Canada remains tariff-exempt. This exemption shields the vast majority of the fresh fruits and vegetables the U.S. sources from its two largest trading partners, maintaining stability for core items like tomatoes, berries, peppers, cucumbers, and leafy greens.

- Mexico secured a 90-day pause on any new duties while negotiations continue. This grace period removes immediate pressure but leaves the door open to future changes, meaning buyers and importers still need to plan for possible policy shifts later in the year.

- Tariffs shifted toward other origins, including Brazil (50%), the European Union (15%), India (25%), South Africa (30%), and several Southeast Asian exporters. These duties primarily hit specialty and seasonal categories: mangoes from Brazil, table grapes from the EU, kiwifruit from New Zealand, citrus from South Africa, and tropical exotics from Southeast Asia.

For the core U.S. fresh produce supply, this pivot meant the immediate crisis eased. Prices and availability for most staple imports were preserved. But the relief is uneven: importers who depend on non-USMCA sources for niche, off-season, or specialty produce now face sharply higher landed costs. In some cases, those costs will be passed through to retailers and consumers; in others, they could lead to sourcing changes, reduced availability, or shorter seasonal windows in the U.S. market.

Will the August 2025 tariffs affect Mexican and Canadian produce?

No, as long as the goods qualify under the USMCA. Approximately 15% of North American produce imports that do not meet USMCA rules still face tariffs. Mexico has a 90-day pause on any new duties while negotiations continue.

Q: Which produce items face the biggest tariff increases?

A: Tariffs now target several non-North American suppliers. This affects specialty and off-season imports more than core staples.

| Country / Region | New Tariff Rate | Potential Produce Impact |

| Brazil | 50% | Tropical fruit, melons, mangoes |

| European Union | 15% | Table grapes, apples, pears |

| New Zealand | 15% | Kiwifruit |

| India | 25% | Mangoes |

| South Africa | 30% | Citrus, grapes |

| Thailand / Vietnam | 19–20% | Tropical fruit |

A Shifting Risk Map

While Mexico and Canada remain core, tariff exposure is growing in other parts of the produce basket:

- Table grapes from the EU, kiwifruit from New Zealand, and Brazilian tropical fruit now face steep duties.

- Specialty categories risk price increases or supply shortages if buyers can’t pivot quickly.

- For importers and retailers, volatility is as much about what changes next as it is about the current rates.

Why Agility is the Real Competitive Advantage

Tariff policy volatility makes agility — the ability to shift sourcing, adapt QC, and maintain customer trust — a mission-critical capability.

Agility in fresh produce means:

- Rapid sourcing pivots: Moving quickly to compliant suppliers or alternative origins without losing product quality.

- Standardized QC across all sources: Ensuring consistent grading, even when bringing on new partners with different practices.

- Real-time quality intelligence: Making accept/divert/discount/reject decisions instantly to prevent waste and protect margins.

- Data-driven forecasting: Using QC trends to anticipate how new origins will perform in shelf life, defect rates, and retailer satisfaction.

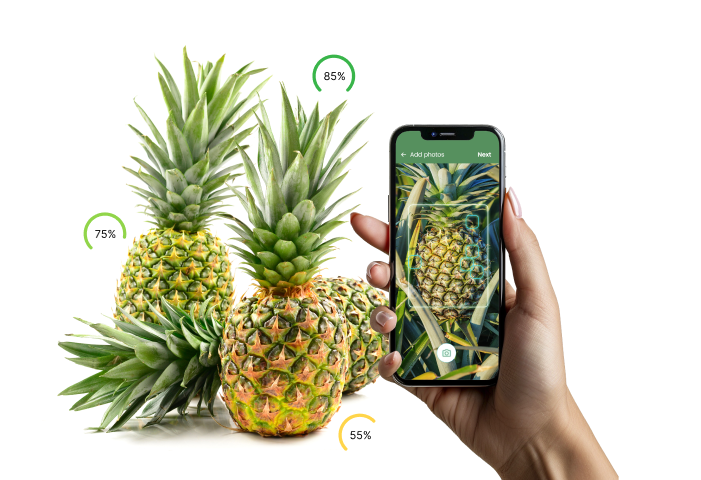

How does AI-powered quality control enable agility?

Agility is only possible if you can trust what you’re moving through your supply chain. AI-powered, mobile, real-time QC makes that possible by:

- Applying the same inspection standards everywhere, eliminating subjectivity.

- Flagging issues immediately so that problem batches can be rerouted before they cause downstream waste.

- Building historical performance profiles for each supplier and origin, making future switches faster and less risky.

QC automation isn’t just about efficiency. It’s the backbone of confident, rapid decision-making.

What Comes Next: Preparing for the Next Policy Shift

Trade policy is now a moving target. The IFPA’s recurring Tariff Town Halls underscore that what’s safe today could be costly tomorrow.

To prepare, produce supply chains should:

- Invest in flexible sourcing networks that can switch between compliant and alternative origins.

- Standardize QC so supplier changes don’t cause quality dips.

- Use predictive analytics to anticipate impacts before they hit.

- Keep decision-making data-rich and real-time.

TL;DR: Fresh Produce and Tariffs

- Mexico & Canada produce exempt under USMCA (90-day pause for Mexico tariffs).

- Tariff risk shifted to specialty imports from Brazil, EU, India, South Africa, etc.

- Agility is critical: sourcing flexibility + standardized QC = resilience.

- QC automation enables rapid, confident decisions in volatile markets.

Turning Policy Shocks into a Competitive Edge

The 2025 tariff story is far from over. Even with the August pivot sparing most USMCA-compliant produce, the shifting risk map is a reminder that trade policy can upend sourcing plans overnight.

By pairing flexible sourcing strategies with AI-powered, standardized quality control, you can protect margins, maintain retailer trust, and move quickly when the rules change. The companies that master this will survive the next policy shock. They may even turn it into a competitive advantage.

Explore how real-time, AI-powered QC can help your supply chain stay agile under any trade scenario.