Subjective Quality Is Costing the Fresh Produce Industry Billions

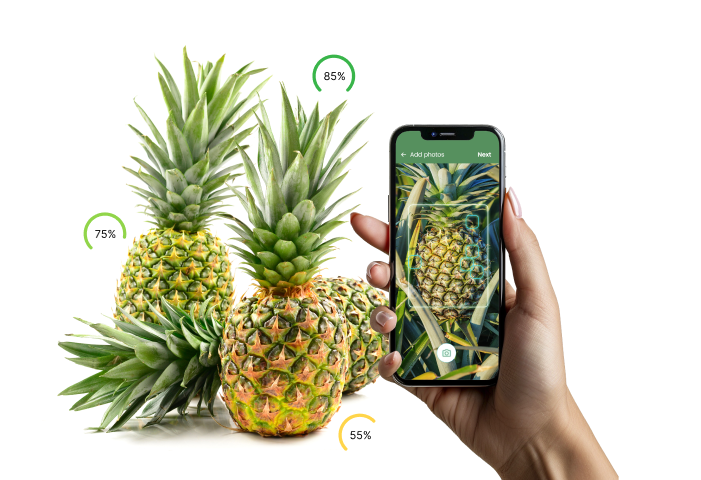

- Quality Control App

Every year, the fresh produce supply chain loses staggering amounts of value to waste, including rejected shipments and downgraded inventory. Perishability and logistics often get the blame as primary causes. But in reality, a less visible factor continues to quietly erode margins across the industry: subjective quality assessment.

According to ReFED’s 2025 U.S. Food Waste Report, unsold and uneaten food reached $382 billion in value in 2023, representing 31% of the total U.S. food supply and 1.4% of GDP. Crucially for fresh produce businesses, more than $108 billion of that loss occurs at the producer and food business level, before food ever reaches consumers.

For marketing companies operating at the center of the fresh produce supply chain, this loss is not abstract. They are often caught between inconsistent quality assessments, commercial expectations, and the financial fallout that follows.

As demand for fresh, high-quality fruits and vegetables continues to rise, relying on individual interpretation rather than shared quality management frameworks is becoming increasingly costly.

The Real Cost of Subjective Quality

Fresh produce rarely fails because it is universally “bad.” More often, it fails because quality is interpreted differently at different points in the supply chain. These differences lead to misalignment between what sellers expect, and what buyers deliver.

For as long as subjective methods predominate, this quality mismatch is almost impossible to remedy. When inspections rely on personal judgment rather than standardized criteria, the same product can be:

- Accepted at origin,

- But challenged at arrival.

- Then, renegotiated or rejected downstream.

Each outcome carries a direct financial consequence.

Studies frequently identify fresh produce as the single most wasted food category in fresh food supply chains. It accounts for 43.7% of all food waste by type in the U.S. This disproportionate impact reflects how sensitive fruits and vegetables are to handling, timing, and, critically, quality decisions.

For marketing companies, these subjective “eye test” decisions translate into more than isolated inspection outcomes. Positioned at the commercial handoff between upstream supply and downstream retail, marketing companies are often the first to absorb the financial and relational consequences of inconsistent quality assessments.

- Price renegotiations that erode planned margins.

- Rejected loads that trigger disposal, rerouting, or secondary sales.

- Shortened shelf life that compresses selling windows.

None of these outcomes are necessarily driven by poor product quality. Many stem from uncertainty: stakeholders lack confidence in the transparency and consistency of quality assessments.

Quality Control for Marketing Companies: Turning an Operational Necessity Into a Commercial Safeguard

One of the fresh produce industry’s most acute challenges is a lack of shared, measurable quality management.

When quality control is subjective, it forces marketing companies to absorb variability across suppliers, inspectors, and markets. But when quality is standardized, it becomes a commercial safeguard.

Defined quality standards that align expectations before product moves.

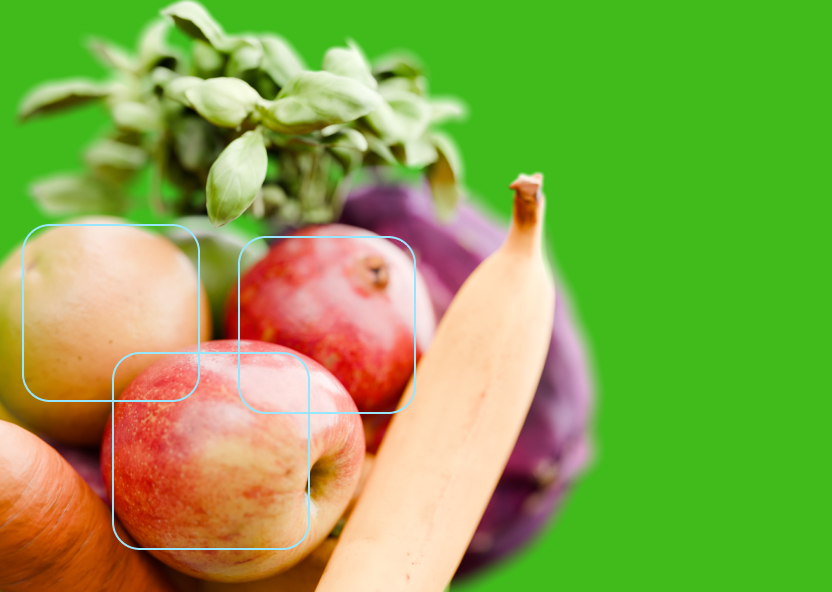

When teams define and share quality criteria upstream, they no longer have to renegotiate load by load. Digital inspection frameworks let marketing companies set a quality standard and apply them consistently across suppliers and locations, so everyone works from the same definition of “acceptable.” This alignment reduces surprises at arrival and cuts down on disputes caused by mismatched expectations at handoff.

Quality assurance processes that replace debate with evidence.

Subjective inspections often trigger drawn-out debates. Emails, photos, and spreadsheets move between parties after value has already disappeared. Modern quality assurance processes capture inspection data in real time, tying objective measurements, defect counts, and visual evidence to each shipment. When teams document quality at the source and share it across stakeholders, conversations shift from opinion to facts. Resolution happens faster, protecting commercial relationships, as well as customer satisfaction.

Continuous improvement driven by measurable benchmarks rather than anecdotes.

Without structured data, quality improvement depends on individual experience and fragmented feedback. By aggregating inspection results over time, marketing companies can spot recurring issues by supplier, variety, or route and address them earlier. Clear benchmarks help teams move beyond one-off fixes toward systematic improvement, reducing repeat losses and strengthening long-term supply performance.

Prevention as Cure

Prevention-focused solutions, those that improve upstream decision-making, could address up to 64% of food waste, delivering a net financial benefit of $60.8 billion over time. That figure underscores a critical point: improving quality assessment is actually a profit lever.

For marketing companies, quality data becomes a way to protect relationships, reduce disputes, and make faster, more confident commercial decisions.

Supply Chain Impact: From Cold Chain to Inventory Loss

Subjectivity creeps into the quality assurance process at inspection. From there, it cascades through the supply chain.

Cold chain decisions depend on accurate assessments of product condition. Without clear, real-time quality insight, storage and routing decisions become conservative by default. Produce may be overcooled, held too long, or rushed unnecessarily. All of these choices end up increasing the risk of spoilage.

Inventory management faces similar challenges. Late or inconsistent quality insights force planners to rely on assumptions rather than facts. High-potential product may miss premium markets, while lower-quality inventory occupies valuable storage space.

When quality visibility is shared in real time across the fresh produce supply chain, decisions shift from reactive to proactive. Product can be routed based on true condition. Shelf-life expectations become more predictable, and the impact of inventory loss gradually tracks downward.

Objective Quality is the Key to Success in Fresh

The demand for fresh, high-quality fruits and vegetables continues to intensify. Retailers expect consistency, consumers notice variability, and marketing companies are left managing the gap.

In this environment, subjective quality no longer scales.

The future of fresh produce supply chain solutions lies in objective quality frameworks that capture product condition in measurable, shareable terms. These frameworks augment human expertise, ensuring that insights travel with the product and inform every downstream decision.

For marketing companies, moving toward objective quality is not about adopting new tools for their own sake. It’s about regaining control in a system where ambiguity is expensive. When quality becomes a shared, trusted source of truth, it stops being a point of friction, and starts becoming a competitive advantage. Book a demo to learn see how objective quality management helps protect revenue by reducing rejections, renegotiations, and avoidable losses.