QC Under Pressure: How to Protect Your Brand When Tariffs Disrupt the Supply Chain

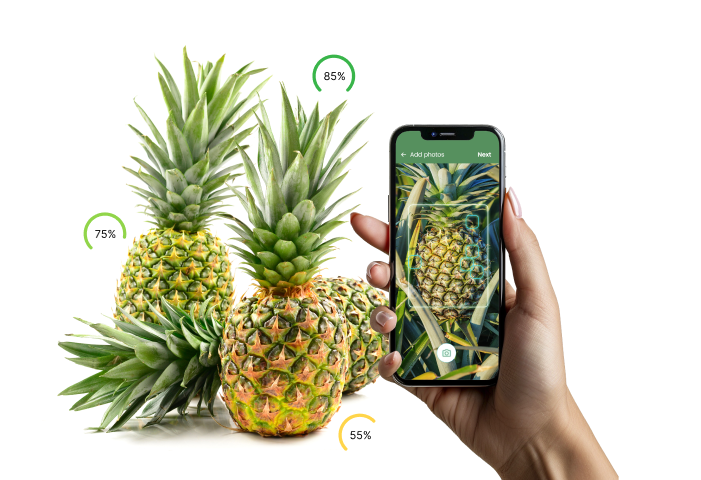

- Quality Control App

When tariffs or trade disputes shake up the fresh produce market, the first headlines are always about prices. But there’s another consequence—less visible at first—that can be just as damaging: brand erosion.

When consumers are asked to pay more for their food, their expectations rise. They also harden. Retail buyers feel it too. A bruised avocado or underripe melon is never welcome, but when margins are squeezed and shoppers are watching every dollar, tolerance for defects disappears.

In volatile markets, quality control becomes brand insurance. The question isn’t only “Can we get product to market?” but “Will our product still meet or exceed expectations under pressure?”

When Prices Go Up, Quality Pressure Follows

Rising prices change the psychology of the market. For everyday staples like tomatoes, berries, and leafy greens, consumers don’t simply “accept” higher prices. They expect more in return for the money they’re spending.

When tariffs raise the landed cost of produce:

- Retail buyers tighten their specs: They need to justify shelf prices to their own customers, so QC thresholds become stricter. For instance, a tomato lot with minor scarring that might have been accepted last season could now be rejected outright.

- End customers scrutinize purchases more closely: Higher prices mean shoppers will reject bruised avocados or underripe berries they might have ignored in a cheaper market.

- Competitors use your slip-ups as leverage: In categories like table grapes and citrus, a single retailer rejection can open the door for another supplier to take your slot.

Without rigorous QC, these market dynamics can turn one bad shipment into a multi-season loss of trust.

Sourcing Shifts Lead to Consistency Risks

One of the immediate effects of tariffs is the need to pivot sourcing to new origins, sometimes with little notice. For exporters, distributors, and retailers, that agility is essential for keeping product flowing. But it also creates a breeding ground for inconsistency.

Think about what happens when you move from a trusted Mexican berry grower to a new supplier in Morocco, or replace your Chilean grape source with an alternative in South Africa:

- Handling practices differ: Post-harvest treatment for citrus in one country may not align with protocols you’ve established for fruit firmness or defect thresholds.

- Climatic conditions impact shelf life: Grapes from a warmer climate may show more stem browning; leafy greens grown in humid regions may arrive with higher decay risk.

- Grading and sorting vary by region: What’s “Grade 1” in one packing facility might be “Grade 2” in another, even if the product looks similar.

Without standardized, data-driven QC across all origins, these differences can chip away at brand consistency, often before anyone realizes the pattern.

Why Data-Driven QC Is Non-Negotiable in Volatile Markets

In a steady market, quality lapses hurt. In a volatile market, they can be brand-killers. The margin for error shrinks because both buyers and consumers are watching more closely.

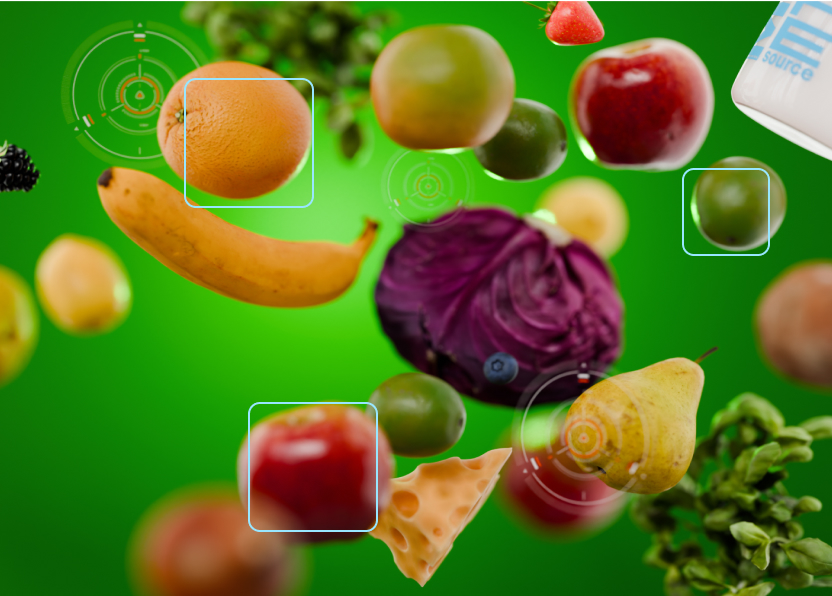

An automated, AI-powered QC platform acts as a safeguard by:

- Applying the same grading standards everywhere: Whether it’s tomatoes from Baja, grapes from the EU, or citrus from South Africa, inspections follow identical criteria, removing subjectivity from the process.

- Providing real-time visibility across the supply chain: You can catch underripe avocados or mold in berry clamshells before they’re loaded, avoiding costly rejections at the retailer dock.

- Building performance profiles for every supplier and origin: Historical QC data reveals how each supplier performs under stress, making future sourcing switches faster and less risky.

- Enabling rapid accept/divert decisions: If a shipment of cucumbers shows higher-than-usual scarring, you can reroute it to a market segment where it still meets spec, preventing both waste and lost sales.

Clarifresh in Action: Enabling Brand Protection in Volatile Markets

In practice, protecting brand equity during tariff-driven disruptions requires more than just “keeping a close eye” on quality. It demands a unified system that delivers clarity, speed, and consistency, no matter the origin. Clarifresh is built to do exactly that:

- Mobile, In-Field Inspections: QC teams can perform inspections anywhere: at the packing shed, port, or distribution center. They can log size, color, defects, and firmness instantly from a mobile device. All produce gets evaluated with the same precision before it ever mixes in the supply chain.

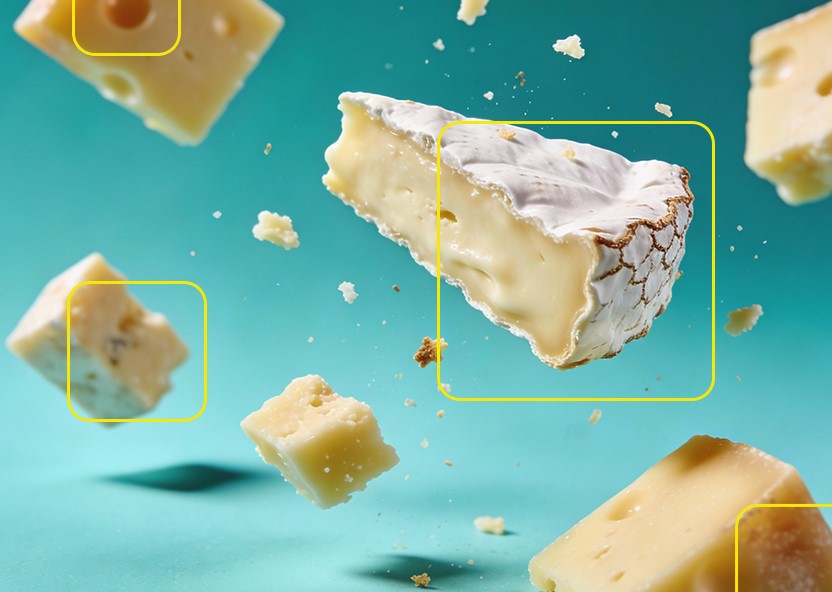

- Automated Defect Detection: Advanced computer vision spots issues like stem browning in grapes or rind blemishes in citrus that human inspectors might miss under time pressure. This reduces the chance of borderline product slipping through during high-volume shifts.

- Standardized Scoring Across All Origins: Every inspection uses the same digital criteria, ensuring a tomato in Morocco is judged exactly like one in Mexico. This eliminates the “inspection drift” that often happens when new suppliers enter the mix.

- Instant Quality Alerts: If an avocado lot shows an unexpected spike in bruising or a berry shipment exceeds mold thresholds, Clarifresh flags it immediately. Teams can decide on the spot whether to divert, discount, or reject, protecting both brand and buyer relationship.

- Performance History by Supplier & Region: Over time, Clarifresh builds a quality profile for each origin. When tariffs force a sourcing switch, procurement can choose partners with a proven record of meeting spec under similar conditions.

By embedding these capabilities into day-to-day operations, exporters and distributors can make fast, evidence-based decisions that protect brand trust.

Real-World Risks When QC Slips Under Tariff Pressure

Price volatility and sourcing changes introduce more than just operational headaches—they can trigger lasting damage if quality control falters. These are the four biggest risks exporters and distributors face when QC standards aren’t airtight:

1. Cancelled Shipments

If a shipment of grapes or berries arrives with defects exceeding agreed thresholds, retailers can refuse it outright. The result? Lost revenue, wasted logistics spend, and perishable inventory that may not find another buyer in time.

2. Produce Stuck in Storage

Delays while negotiating acceptance or pricing for an off-spec load shorten shelf life and reduce market value. A citrus container held for even a few days in port can see juice content drop and decay rates spike.

3. Strained Retailer Relationships

A single missed QC mark in high-value categories like avocados or premium tomatoes can erode years of trust. Buyers remember which suppliers deliver.

4. Brand Damage at the Shelf

Consumers don’t blame tariffs for disappointing quality. They blame the brand on the label or the store selling it. A poor eating experience can undo months of marketing and category development work.

Turning Volatility Into a Trust-Building Moment

While volatility is stressful, it’s also a chance to stand out in a crowded supplier landscape. When competitors are making excuses, the suppliers who deliver consistently high-quality produce become indispensable to retailers.

Exporters and distributors who invest in AI-powered, standardized QC during tariff turbulence can:

- Maintain category-leading consistency across all origins, whether they’re sourcing tomatoes from Mexico or citrus from Spain.

- Proactively communicate spec compliance to buyers, reinforcing trust.

- Use QC data as a proof point in negotiations, showing retailers that you’re meeting or exceeding expectations despite market headwinds.

- Build a track record of reliability that helps secure contracts beyond the current tariff cycle.

Tariffs and trade disputes may be outside your control. Your quality isn’t.

In times of market volatility, QC should be treated as a way of protecting your brand equity, safeguarding your retailer relationships, and making sure the products that carry your name exceed expectations, no matter where they come from.

The exporters and distributors who treat quality as a strategic asset will emerge from market turbulence stronger, more trusted, and more competitive than before.